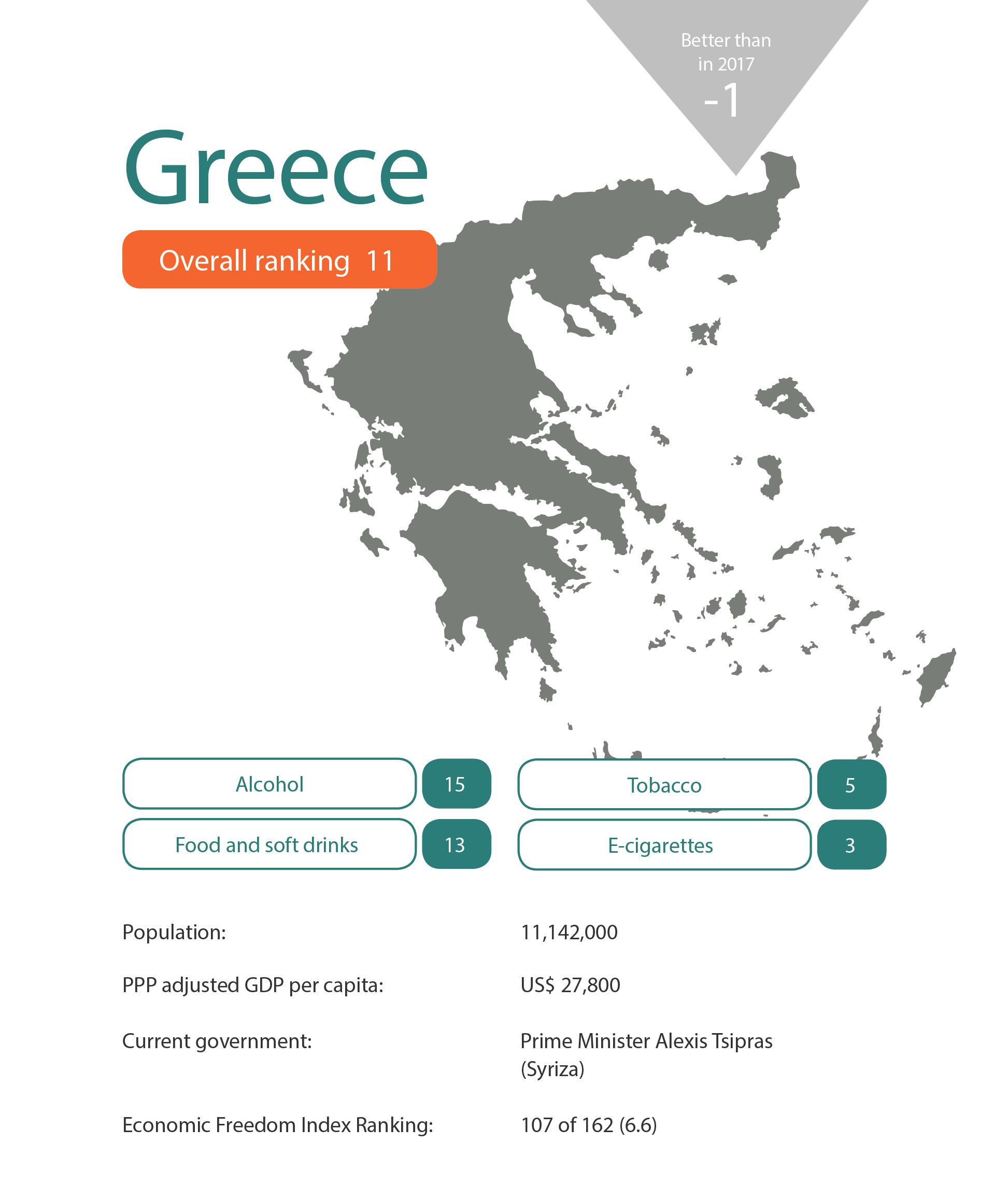

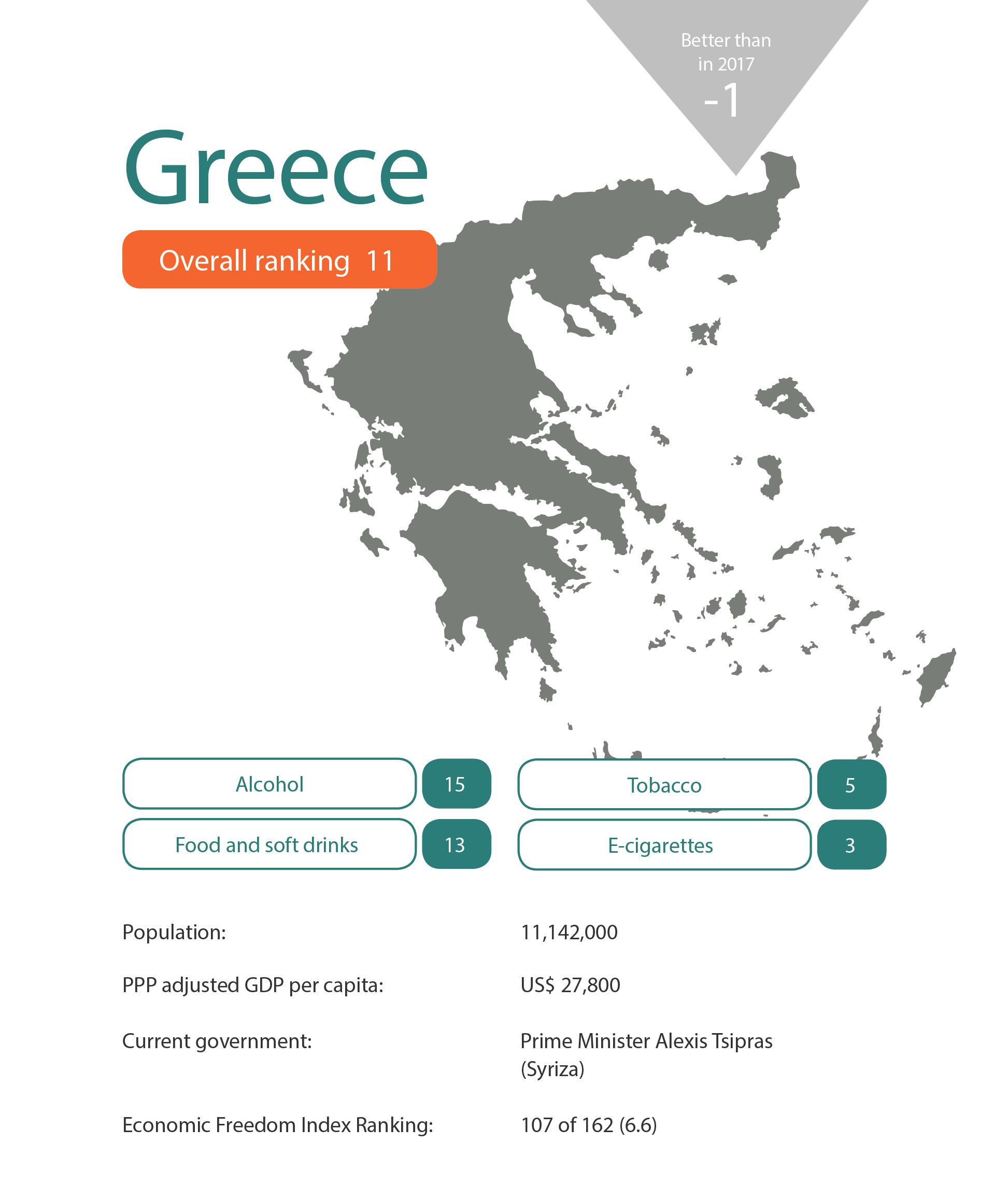

Greek sin taxes are punitive, especially once they are adjusted for income. Taxes on spirits and beer are the EU’s third and fourth highest respectively. Greece’s tobacco duty is the fourth highest in the EU after adjusting for income. The Syriza government introduced a tax on wine for the first time in 2016, but this was annulled by Greece’s supreme administrative court in September 2018 and was abolished in January 2019.

A tax on e-cigarettes came into effect in January 2017 (at €0.10 per ml) and, as the government tries to balance the books, there have been tax rises on beer, cigarettes, coffee and ‘electronically heated tobacco products’ in recent years (the latter is €156.70 per kilogram).

Despite potential fines of up to €10,000, Greece’s smoking ban is notorious for being ignored by the public and the authorities alike. Officially, smoking is prohibited in nearly all workplaces, bars and restaurants. There is an exemption for casinos and bars larger than 300 square metres which can allow smoking in designated areas no larger than half of the total floor space. Smoking in taxis and public transport is forbidden as well as in private vehicles if there is a passenger under 12 years old.

Tobacco retail displays are banned with the exception of specialist tobacco outlets such as kiosks and duty-free shops. The sale of cigarettes from vending machines was banned in 2009. Greece has the highest smoking rate in the EU.

E-cigarettes are legal but the Greek government banned zero-nicotine fluids in 2018 in an attempt to stop vapers mixing their own fluid. Greeks cannot buy e-cigarettes or vaping fluids from other EU countries by mail order. E-cigarette advertising is banned everywhere except at point of sale and a tax on e-cigarette fluid of €0.10 per ml was introduced in January 2017. Vaping has been banned wherever smoking is banned since 2016. In March 2018, Greece’s High Court upheld the ban on vaping indoors.

There have been mandatory limits on the amount of salt that can be put in manufactured bread, tomato juice and tomato concentrates since 1971. Until August 2014, Greek law stated that bread must be sold in pieces of 250, 350, 500, 750 or 1000 grams, but that rule has been replaced by a law dictating that each piece of bread must be weighed for the consumer to pay the exact amount according to the price per kilo.

Alcohol advertising is mostly unrestricted although it cannot be broadcast on TV and radio during programmes that are targeted at children.

With thanks to Constantinos Saravakos, KEFIM – Centre for Liberal Studies

About

The Nanny State Index (NSI) is a league table of the worst places in Europe to eat, drink, smoke and vape. The initiative was launched in March 2016 and was a media hit right across Europe. It is masterminded and led by IEA’s Christopher Snowdon with partners from all over Europe.

Enquiries: info@epicenternetwork.eu

Download Publication

Previous version: 2019

Categories

About the Editor

Christopher Snowdon is the head of Lifestyle Economics at the Institute of Economic Affairs. His research focuses on lifestyle freedoms, prohibition and policy-based evidence. He is a regular contributor to the Spectator, Telegraph and Spiked and often appears on TV and radio discussing social and economic issues.

Snowdon’s work encompasses a diverse range of topics including ‘sin taxes’, state funding of charities, happiness economics, ‘public health’ regulation, gambling and the black market. Recent publications include ‘Drinking, Fast and Slow’, ‘The Proof of the Pudding: Denmark’s Fat Tax Fiasco’, ‘A Safer Bet’, and ‘You Had One Job’. He is also the author of ‘Killjoys’ (2017), ‘Selfishness, Greed and Capitalism’ (2015), ‘The Art of Suppression’ (2011), ‘The Spirit Level Delusion’ (2010), ‘Velvet Glove, Iron Fist’ (2009).

Greece 2019

Greek sin taxes are punitive, especially once they are adjusted for income. Taxes on spirits and beer are the EU’s third and fourth highest respectively. Greece’s tobacco duty is the fourth highest in the EU after adjusting for income. The Syriza government introduced a tax on wine for the first time in 2016, but this was annulled by Greece’s supreme administrative court in September 2018 and was abolished in January 2019.

A tax on e-cigarettes came into effect in January 2017 (at €0.10 per ml) and, as the government tries to balance the books, there have been tax rises on beer, cigarettes, coffee and ‘electronically heated tobacco products’ in recent years (the latter is €156.70 per kilogram).

Despite potential fines of up to €10,000, Greece’s smoking ban is notorious for being ignored by the public and the authorities alike. Officially, smoking is prohibited in nearly all workplaces, bars and restaurants. There is an exemption for casinos and bars larger than 300 square metres which can allow smoking in designated areas no larger than half of the total floor space. Smoking in taxis and public transport is forbidden as well as in private vehicles if there is a passenger under 12 years old.

Tobacco retail displays are banned with the exception of specialist tobacco outlets such as kiosks and duty-free shops. The sale of cigarettes from vending machines was banned in 2009. Greece has the highest smoking rate in the EU.

E-cigarettes are legal but the Greek government banned zero-nicotine fluids in 2018 in an attempt to stop vapers mixing their own fluid. Greeks cannot buy e-cigarettes or vaping fluids from other EU countries by mail order. E-cigarette advertising is banned everywhere except at point of sale and a tax on e-cigarette fluid of €0.10 per ml was introduced in January 2017. Vaping has been banned wherever smoking is banned since 2016. In March 2018, Greece’s High Court upheld the ban on vaping indoors.

There have been mandatory limits on the amount of salt that can be put in manufactured bread, tomato juice and tomato concentrates since 1971. Until August 2014, Greek law stated that bread must be sold in pieces of 250, 350, 500, 750 or 1000 grams, but that rule has been replaced by a law dictating that each piece of bread must be weighed for the consumer to pay the exact amount according to the price per kilo.

Alcohol advertising is mostly unrestricted although it cannot be broadcast on TV and radio during programmes that are targeted at children.

With thanks to Constantinos Saravakos, KEFIM – Centre for Liberal Studies

Austria

Austria Belgium

Belgium Bulgaria

Bulgaria Croatia

Croatia Cyprus

Cyprus Czech Republic

Czech Republic Denmark

Denmark Estonia

Estonia Finland

Finland France

France Germany

Germany Greece

Greece Hungary

Hungary Ireland

Ireland Italy

Italy Latvia

Latvia Lithuania

Lithuania Luxembourg

Luxembourg Malta

Malta Netherlands

Netherlands Norway

Norway Poland

Poland Portugal

Portugal Romania

Romania Slovakia

Slovakia Slovenia

Slovenia Spain

Spain Sweden

Sweden Turkey

Turkey United Kingdom

United Kingdom