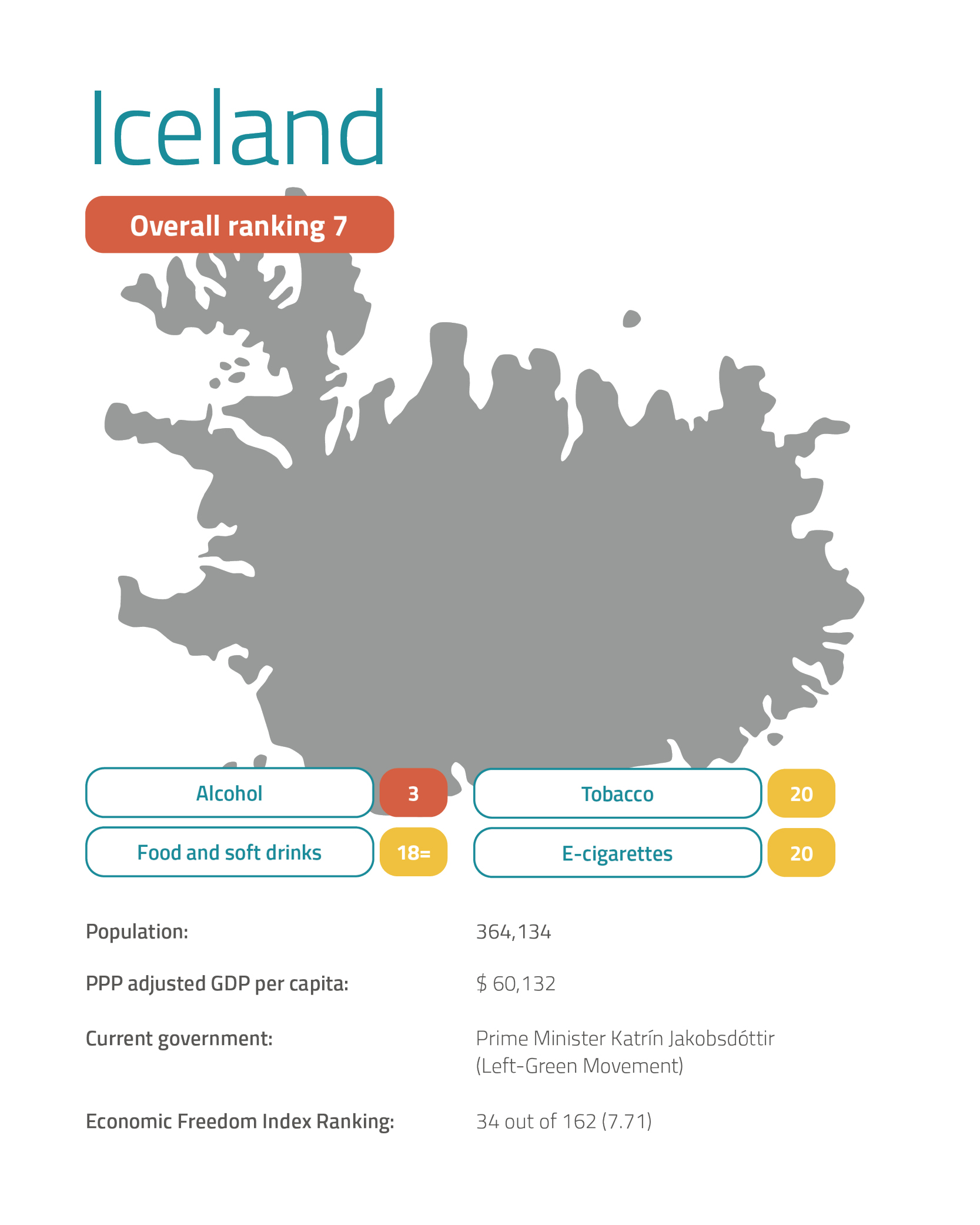

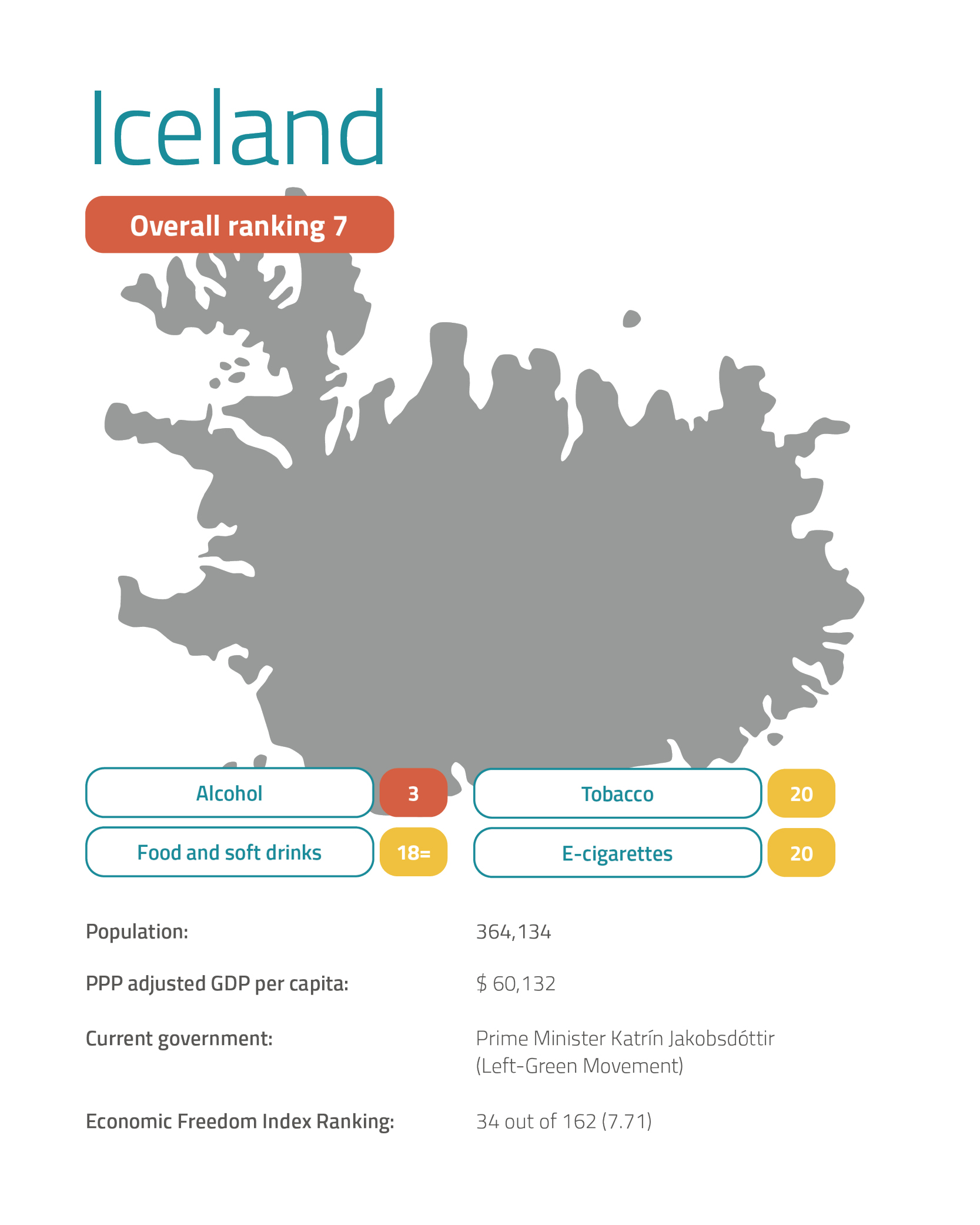

Iceland comes seventh in the expanded Nanny State Index, trailing two other Nordic nations, Finland and Norway. As in those countries, Iceland has a state monopoly on alcohol retail and some very high sin taxes. Alcohol advertising is completely banned, but happy hours are legal and quite common. In February 2020, the Minister of Justice Áslaug Arna Sigurbjörnsdóttir drafted a bill to legalise alcohol advertising and allow liquor stores to sell online. She argued that alcohol advertising is often seen in Iceland as a result of foreign media and international sports events and that relaxing the ban would allow domestic producers to compete. Nothing has come of this yet.

There is no national closing time for bars and restaurants, although most municipalities require last orders to be called between 3 am and 5 am, and you have to be 20 years old to buy a drink anywhere.

Alcohol taxes are exceptionally punitive. The tax on a typical bottle of whisky is 6,044 Króna (€44.35). The tax on a litre of standard lager is 337.15 Króna (€2.46) and the tax on an average 75cl bottle of wine is 570 Króna (€4.17). Even after adjusting for income, these are some of the highest rates in Europe.

Tobacco duty is more reasonable at 503 Króna (€3.68) for a pack of twenty cigarettes, albeit subject to VAT at 24 per cent. However, the government takes a further cut when they are sold because tobacco retailing is also a state monopoly. The price range of cigarettes in the shops is between 1,200 and 1,600 Króna (€8.70 to €11.60).

All forms of tobacco advertising are banned and it is even against the law to import, manufacture and sell toys or sweets that look like cigars, cigarettes or pipes. There is a tobacco display ban with an exemption for specialist tobacconists. Cigarette vending machines are banned, but the government has so far rejected plain packaging. Despite the cold, Iceland’s smoking ban is unforgiving, with no exemptions in the hospitality industry. There is no ban on smoking outdoors or in private vehicles.

As in other Nordic countries, smokeless tobacco is popular with the public but not with politicians. Between 2008 and 2017, cigarette consumption halved while smokeless tobacco consumption doubled. Snus has been banned for years and so many Icelanders make their own by wrapping nasal snuff in special snus paper. Today, only nine per cent of Icelanders are daily smokers.

E-cigarettes have become increasingly popular in recent years and four per cent of the population vapes daily. They are free to do so. E-cigarettes and vape juice are legal and vaping is only prohibited in government-owned buildings and on public transport. Mail order sales from overseas are permitted. Aside from following the EU line on e-cigarette regulation, the main restrictions are on marketing. E-cigarettes cannot be advertised in any form and cannot be displayed in shop windows.

There are no sin taxes on e-cigarette fluid, food or soft drinks, although a twenty per cent soda tax was proposed by the Directorate of Health in July 2019.

Thanks to Júlíus Viggó Ólafsson at Students for Liberty Iceland

About

The Nanny State Index (NSI) is a league table of the worst places in Europe to eat, drink, smoke and vape. The initiative was launched in March 2016 and was a media hit right across Europe. It is masterminded and led by IEA’s Christopher Snowdon with partners from all over Europe.

Enquiries: info@epicenternetwork.eu

Download Publication

Previous version: 2019

Categories

About the Editor

Christopher Snowdon is the head of Lifestyle Economics at the Institute of Economic Affairs. His research focuses on lifestyle freedoms, prohibition and policy-based evidence. He is a regular contributor to the Spectator, Telegraph and Spiked and often appears on TV and radio discussing social and economic issues.

Snowdon’s work encompasses a diverse range of topics including ‘sin taxes’, state funding of charities, happiness economics, ‘public health’ regulation, gambling and the black market. Recent publications include ‘Drinking, Fast and Slow’, ‘The Proof of the Pudding: Denmark’s Fat Tax Fiasco’, ‘A Safer Bet’, and ‘You Had One Job’. He is also the author of ‘Killjoys’ (2017), ‘Selfishness, Greed and Capitalism’ (2015), ‘The Art of Suppression’ (2011), ‘The Spirit Level Delusion’ (2010), ‘Velvet Glove, Iron Fist’ (2009).

Iceland 2021

Iceland comes seventh in the expanded Nanny State Index, trailing two other Nordic nations, Finland and Norway. As in those countries, Iceland has a state monopoly on alcohol retail and some very high sin taxes. Alcohol advertising is completely banned, but happy hours are legal and quite common. In February 2020, the Minister of Justice Áslaug Arna Sigurbjörnsdóttir drafted a bill to legalise alcohol advertising and allow liquor stores to sell online. She argued that alcohol advertising is often seen in Iceland as a result of foreign media and international sports events and that relaxing the ban would allow domestic producers to compete. Nothing has come of this yet.

There is no national closing time for bars and restaurants, although most municipalities require last orders to be called between 3 am and 5 am, and you have to be 20 years old to buy a drink anywhere.

Alcohol taxes are exceptionally punitive. The tax on a typical bottle of whisky is 6,044 Króna (€44.35). The tax on a litre of standard lager is 337.15 Króna (€2.46) and the tax on an average 75cl bottle of wine is 570 Króna (€4.17). Even after adjusting for income, these are some of the highest rates in Europe.

Tobacco duty is more reasonable at 503 Króna (€3.68) for a pack of twenty cigarettes, albeit subject to VAT at 24 per cent. However, the government takes a further cut when they are sold because tobacco retailing is also a state monopoly. The price range of cigarettes in the shops is between 1,200 and 1,600 Króna (€8.70 to €11.60).

All forms of tobacco advertising are banned and it is even against the law to import, manufacture and sell toys or sweets that look like cigars, cigarettes or pipes. There is a tobacco display ban with an exemption for specialist tobacconists. Cigarette vending machines are banned, but the government has so far rejected plain packaging. Despite the cold, Iceland’s smoking ban is unforgiving, with no exemptions in the hospitality industry. There is no ban on smoking outdoors or in private vehicles.

As in other Nordic countries, smokeless tobacco is popular with the public but not with politicians. Between 2008 and 2017, cigarette consumption halved while smokeless tobacco consumption doubled. Snus has been banned for years and so many Icelanders make their own by wrapping nasal snuff in special snus paper. Today, only nine per cent of Icelanders are daily smokers.

E-cigarettes have become increasingly popular in recent years and four per cent of the population vapes daily. They are free to do so. E-cigarettes and vape juice are legal and vaping is only prohibited in government-owned buildings and on public transport. Mail order sales from overseas are permitted. Aside from following the EU line on e-cigarette regulation, the main restrictions are on marketing. E-cigarettes cannot be advertised in any form and cannot be displayed in shop windows.

There are no sin taxes on e-cigarette fluid, food or soft drinks, although a twenty per cent soda tax was proposed by the Directorate of Health in July 2019.

Thanks to Júlíus Viggó Ólafsson at Students for Liberty Iceland

Austria

Austria Belgium

Belgium Bulgaria

Bulgaria Croatia

Croatia Cyprus

Cyprus Czech Republic

Czech Republic Denmark

Denmark Estonia

Estonia Finland

Finland France

France Germany

Germany Greece

Greece Hungary

Hungary Ireland

Ireland Italy

Italy Latvia

Latvia Lithuania

Lithuania Luxembourg

Luxembourg Malta

Malta Netherlands

Netherlands Norway

Norway Poland

Poland Portugal

Portugal Romania

Romania Slovakia

Slovakia Slovenia

Slovenia Spain

Spain Sweden

Sweden Turkey

Turkey United Kingdom

United Kingdom