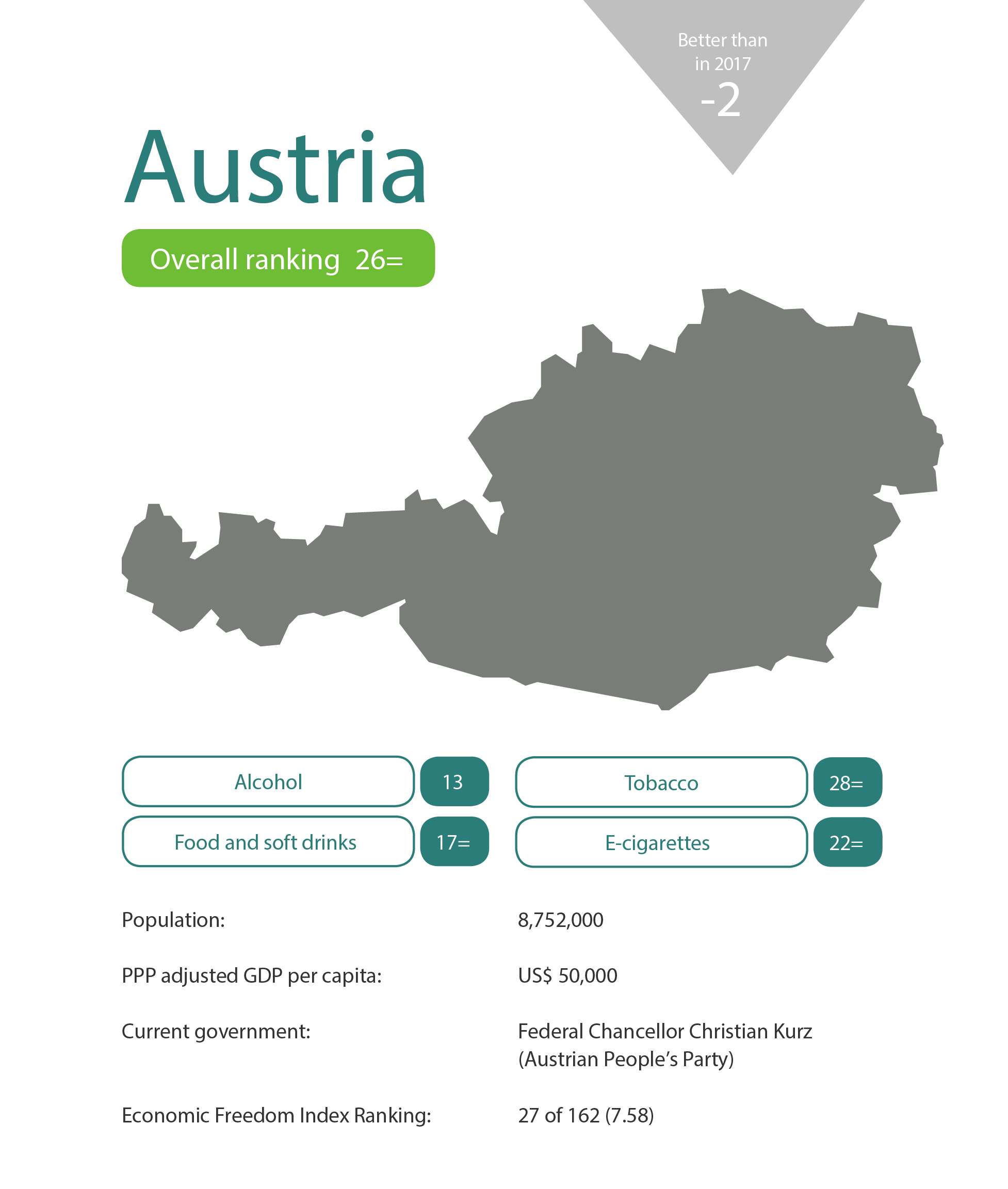

Austria has a good record of resisting nanny state interference. Its tobacco tax is amongst the lowest in Western Europe and it is one of the 14 EU member states that have no duty on wine (except sparkling wine). Taxes on beer and spirits are relatively low.

Tobacco advertising is only allowed at point of sale, but there is no ban on cigarette vending machines, no display ban and no serious talk of plain packaging.

Austria was due to introduce a wide-ranging smoking ban in 2018 which would have included vaping but this plan was dropped by the new government in December 2017. Its only concession was to introduce a ban on smoking in cars with passengers under the age of 18. This ban includes e-cigarettes but there are no other major restrictions on where people can vape in Austria.

E-cigarettes were once classified as medicinal products and effectively banned. That is no longer the case. E-cigarettes and vape juice are available as consumer products and there is no specific tax on e-cigarette fluid. Cross-border sales are banned, however.

Austria takes a firm line on spirits advertising which is banned on television, radio and on billboards. Alcohol sponsorship is also banned outright, but beer and wine can be advertised in all media.

Calls to interfere with people’s diets have largely fallen on deaf ears in Austria, although trans fats are limited in food by law to two per cent (by weight) or, in some products, four per cent.

With thanks to the Friedrich A. von Hayek Institut

About

The Nanny State Index (NSI) is a league table of the worst places in Europe to eat, drink, smoke and vape. The initiative was launched in March 2016 and was a media hit right across Europe. It is masterminded and led by IEA’s Christopher Snowdon with partners from all over Europe.

Enquiries: info@epicenternetwork.eu

Download Publication

Previous version: 2019

Categories

About the Editor

Christopher Snowdon is the head of Lifestyle Economics at the Institute of Economic Affairs. His research focuses on lifestyle freedoms, prohibition and policy-based evidence. He is a regular contributor to the Spectator, Telegraph and Spiked and often appears on TV and radio discussing social and economic issues.

Snowdon’s work encompasses a diverse range of topics including ‘sin taxes’, state funding of charities, happiness economics, ‘public health’ regulation, gambling and the black market. Recent publications include ‘Drinking, Fast and Slow’, ‘The Proof of the Pudding: Denmark’s Fat Tax Fiasco’, ‘A Safer Bet’, and ‘You Had One Job’. He is also the author of ‘Killjoys’ (2017), ‘Selfishness, Greed and Capitalism’ (2015), ‘The Art of Suppression’ (2011), ‘The Spirit Level Delusion’ (2010), ‘Velvet Glove, Iron Fist’ (2009).

Austria 2019

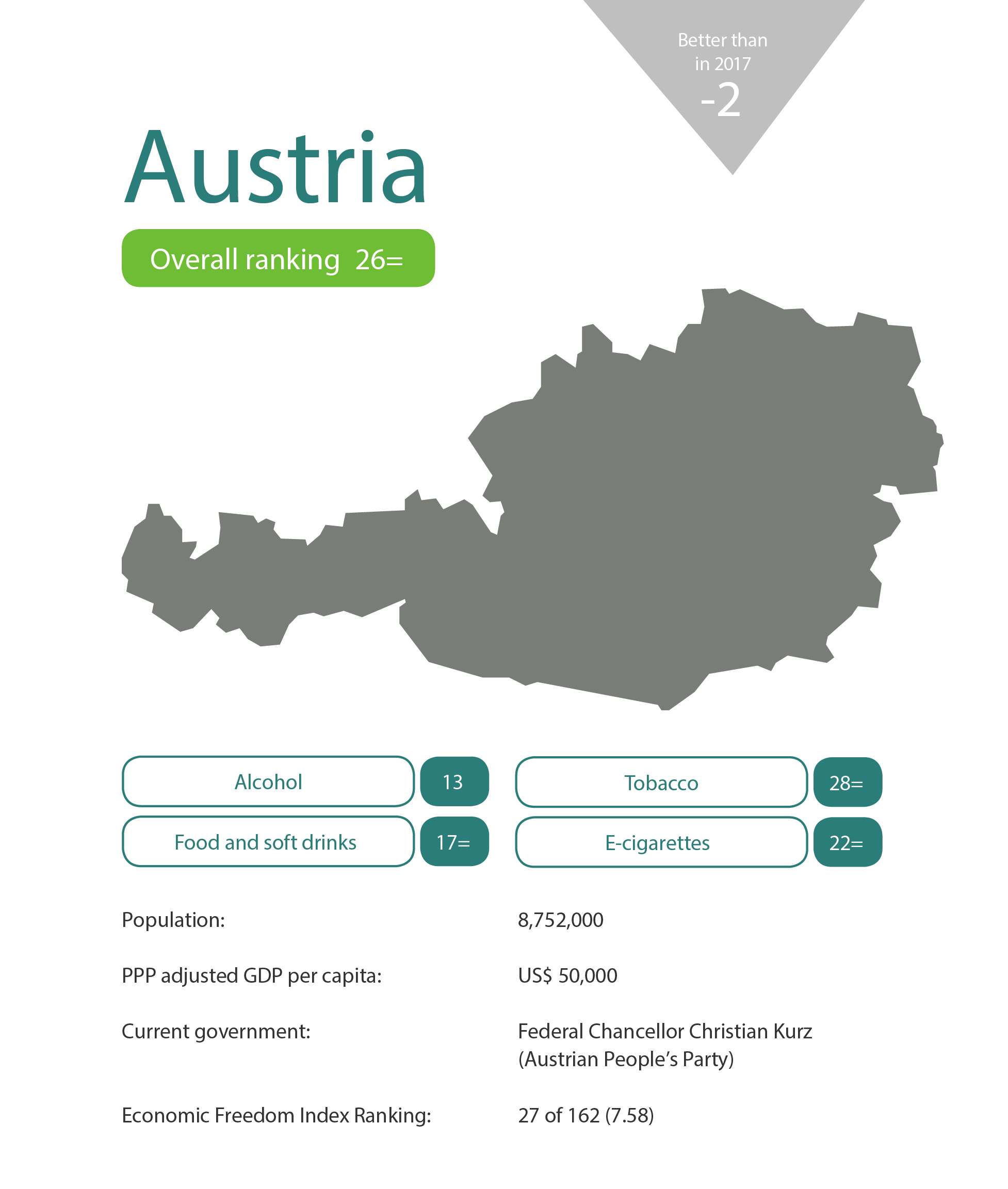

Austria has a good record of resisting nanny state interference. Its tobacco tax is amongst the lowest in Western Europe and it is one of the 14 EU member states that have no duty on wine (except sparkling wine). Taxes on beer and spirits are relatively low.

Tobacco advertising is only allowed at point of sale, but there is no ban on cigarette vending machines, no display ban and no serious talk of plain packaging.

Austria was due to introduce a wide-ranging smoking ban in 2018 which would have included vaping but this plan was dropped by the new government in December 2017. Its only concession was to introduce a ban on smoking in cars with passengers under the age of 18. This ban includes e-cigarettes but there are no other major restrictions on where people can vape in Austria.

E-cigarettes were once classified as medicinal products and effectively banned. That is no longer the case. E-cigarettes and vape juice are available as consumer products and there is no specific tax on e-cigarette fluid. Cross-border sales are banned, however.

Austria takes a firm line on spirits advertising which is banned on television, radio and on billboards. Alcohol sponsorship is also banned outright, but beer and wine can be advertised in all media.

Calls to interfere with people’s diets have largely fallen on deaf ears in Austria, although trans fats are limited in food by law to two per cent (by weight) or, in some products, four per cent.

With thanks to the Friedrich A. von Hayek Institut

Austria

Austria Belgium

Belgium Bulgaria

Bulgaria Croatia

Croatia Cyprus

Cyprus Czech Republic

Czech Republic Denmark

Denmark Estonia

Estonia Finland

Finland France

France Germany

Germany Greece

Greece Hungary

Hungary Ireland

Ireland Italy

Italy Latvia

Latvia Lithuania

Lithuania Luxembourg

Luxembourg Malta

Malta Netherlands

Netherlands Norway

Norway Poland

Poland Portugal

Portugal Romania

Romania Slovakia

Slovakia Slovenia

Slovenia Spain

Spain Sweden

Sweden Turkey

Turkey United Kingdom

United Kingdom