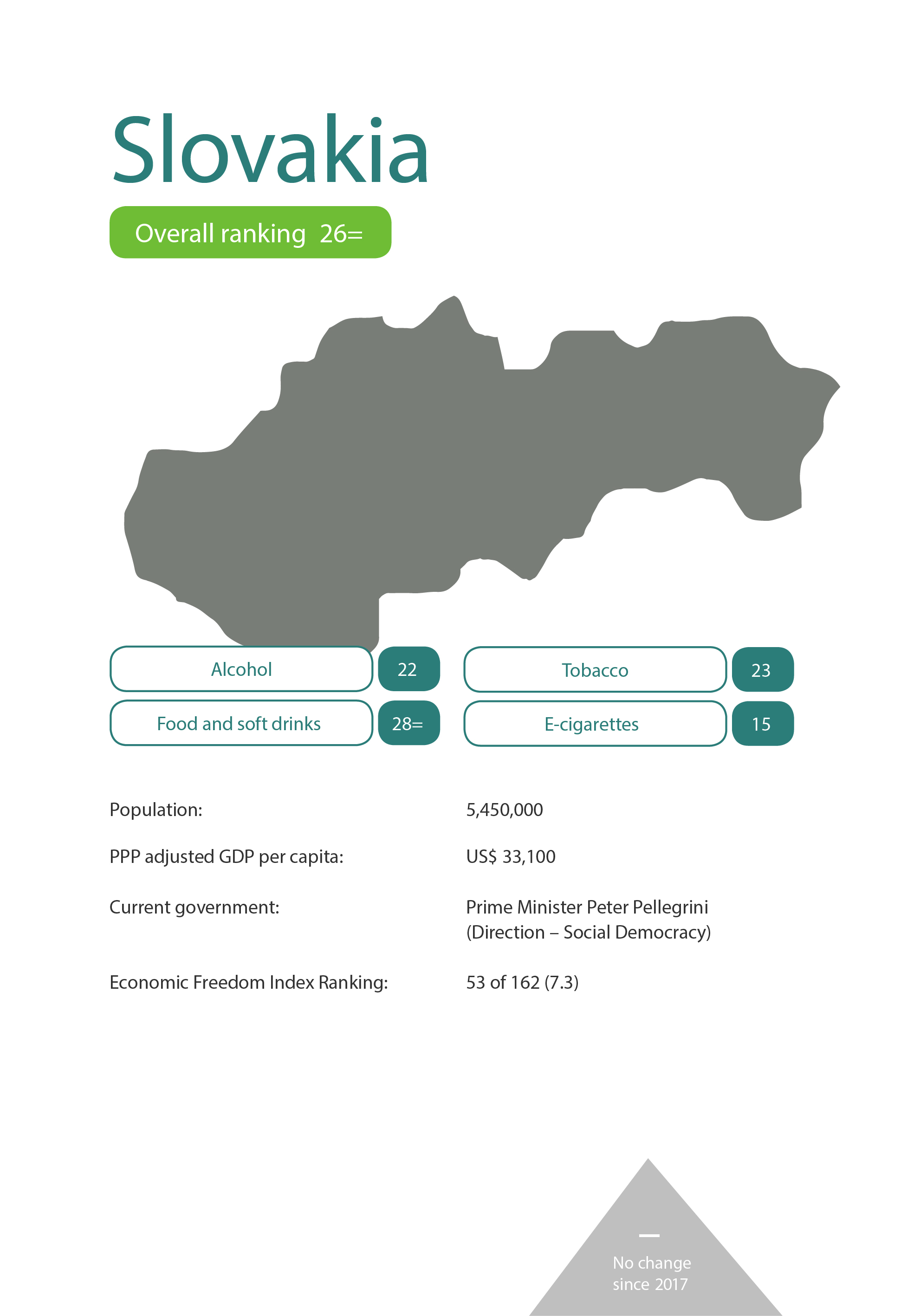

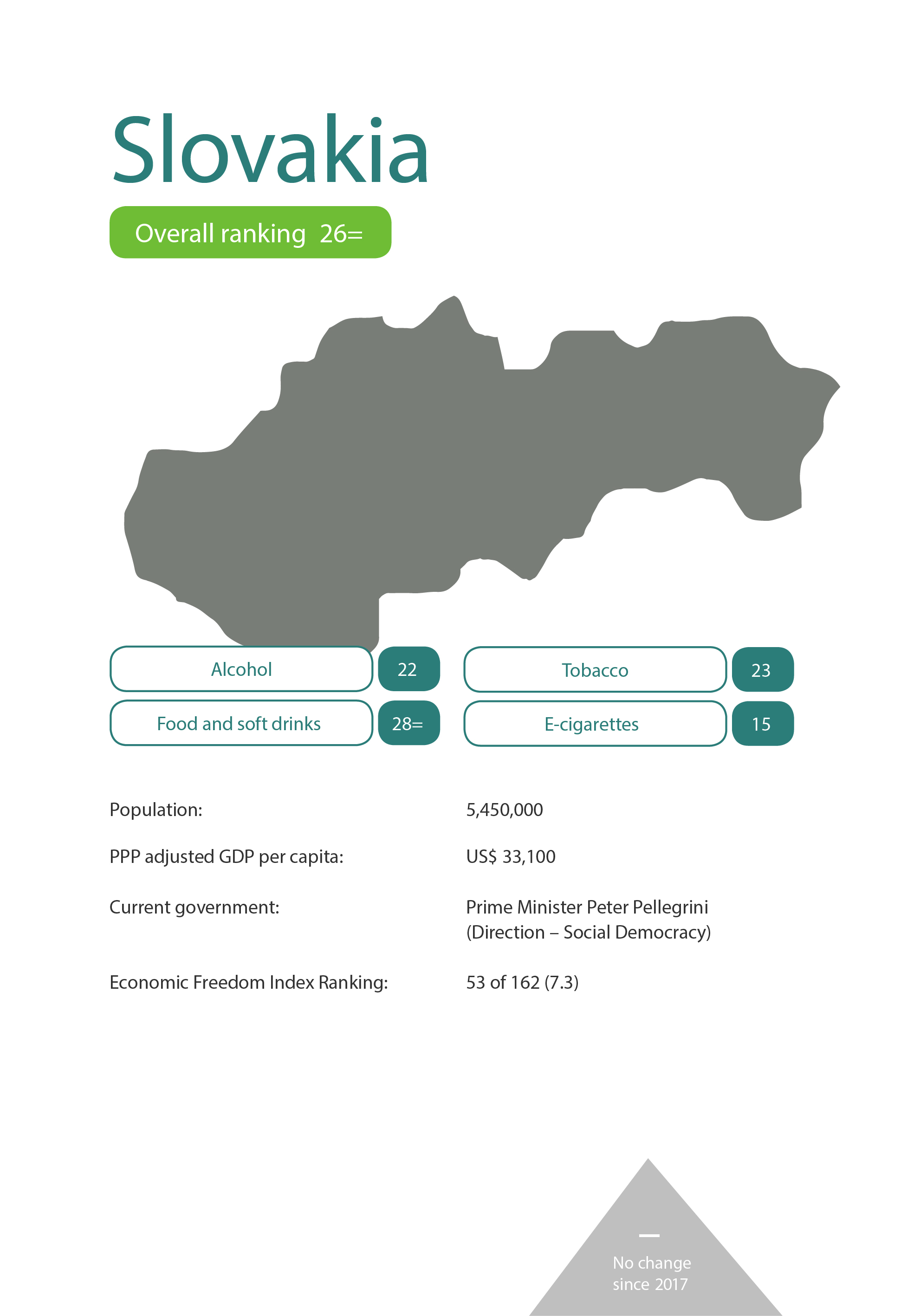

Slovakia’s tax rate on beer is low and there is no duty on wine, although sparkling wine is taxed at €0.80 per litre. Duty on spirits is higher but still below the EU average. Tobacco duty is well below average and the Slovakian smoking ban allows owners of bars and restaurants to accommodate smokers in separate sections. Cigarettes cannot be bought from machines but there is no display ban. Nor are there any restrictions on where and when alcohol can be advertised.

Slovakia’s approach to social freedoms is sounder than most, but it is far from perfect. Although smoking is only partially banned indoors, vaping is prohibited wherever smoking is banned. E-cigarette advertising and sponsorship is banned, as are cross-border sales. Slovakia is also one of only four EU member states where it is illegal to drink any quantity of alcohol before driving. Until January 2017, this zero tolerance approach also applied to cyclists on cycle lanes but the law has since been changed to allow cyclists to consume one pint of beer (ie. the blood alcohol concentration limit has been raised to 0.05%).

In a further act of mild liberalisation, the government legalised domestic distilling in January 2019. Slovakians are now permitted to produce up to 25 litres of ethyl alcohol in their own home each year – enough to produce around 50 litres of spirits – so long as they use homegrown fruit and register with the government. These drinks cannot be sold to others.

In May 2017, Slovakia introduced a specific tax of €73.90 per kg on ‘smokeless tobacco’ to cover new heat-not-burn products. This rose to €76.70 in February 2019. There is currently no excise tax on e-cigarette fluid.

With thanks to Radovan Durana, Institute of Economic and Social Studies

About

The Nanny State Index (NSI) is a league table of the worst places in Europe to eat, drink, smoke and vape. The initiative was launched in March 2016 and was a media hit right across Europe. It is masterminded and led by IEA’s Christopher Snowdon with partners from all over Europe.

Enquiries: info@epicenternetwork.eu

Download Publication

Previous version: 2019

Categories

About the Editor

Christopher Snowdon is the head of Lifestyle Economics at the Institute of Economic Affairs. His research focuses on lifestyle freedoms, prohibition and policy-based evidence. He is a regular contributor to the Spectator, Telegraph and Spiked and often appears on TV and radio discussing social and economic issues.

Snowdon’s work encompasses a diverse range of topics including ‘sin taxes’, state funding of charities, happiness economics, ‘public health’ regulation, gambling and the black market. Recent publications include ‘Drinking, Fast and Slow’, ‘The Proof of the Pudding: Denmark’s Fat Tax Fiasco’, ‘A Safer Bet’, and ‘You Had One Job’. He is also the author of ‘Killjoys’ (2017), ‘Selfishness, Greed and Capitalism’ (2015), ‘The Art of Suppression’ (2011), ‘The Spirit Level Delusion’ (2010), ‘Velvet Glove, Iron Fist’ (2009).

Slovakia 2019

Slovakia’s tax rate on beer is low and there is no duty on wine, although sparkling wine is taxed at €0.80 per litre. Duty on spirits is higher but still below the EU average. Tobacco duty is well below average and the Slovakian smoking ban allows owners of bars and restaurants to accommodate smokers in separate sections. Cigarettes cannot be bought from machines but there is no display ban. Nor are there any restrictions on where and when alcohol can be advertised.

Slovakia’s approach to social freedoms is sounder than most, but it is far from perfect. Although smoking is only partially banned indoors, vaping is prohibited wherever smoking is banned. E-cigarette advertising and sponsorship is banned, as are cross-border sales. Slovakia is also one of only four EU member states where it is illegal to drink any quantity of alcohol before driving. Until January 2017, this zero tolerance approach also applied to cyclists on cycle lanes but the law has since been changed to allow cyclists to consume one pint of beer (ie. the blood alcohol concentration limit has been raised to 0.05%).

In a further act of mild liberalisation, the government legalised domestic distilling in January 2019. Slovakians are now permitted to produce up to 25 litres of ethyl alcohol in their own home each year – enough to produce around 50 litres of spirits – so long as they use homegrown fruit and register with the government. These drinks cannot be sold to others.

In May 2017, Slovakia introduced a specific tax of €73.90 per kg on ‘smokeless tobacco’ to cover new heat-not-burn products. This rose to €76.70 in February 2019. There is currently no excise tax on e-cigarette fluid.

With thanks to Radovan Durana, Institute of Economic and Social Studies

Austria

Austria Belgium

Belgium Bulgaria

Bulgaria Croatia

Croatia Cyprus

Cyprus Czech Republic

Czech Republic Denmark

Denmark Estonia

Estonia Finland

Finland France

France Germany

Germany Greece

Greece Hungary

Hungary Ireland

Ireland Italy

Italy Latvia

Latvia Lithuania

Lithuania Luxembourg

Luxembourg Malta

Malta Netherlands

Netherlands Norway

Norway Poland

Poland Portugal

Portugal Romania

Romania Slovakia

Slovakia Slovenia

Slovenia Spain

Spain Sweden

Sweden Turkey

Turkey United Kingdom

United Kingdom