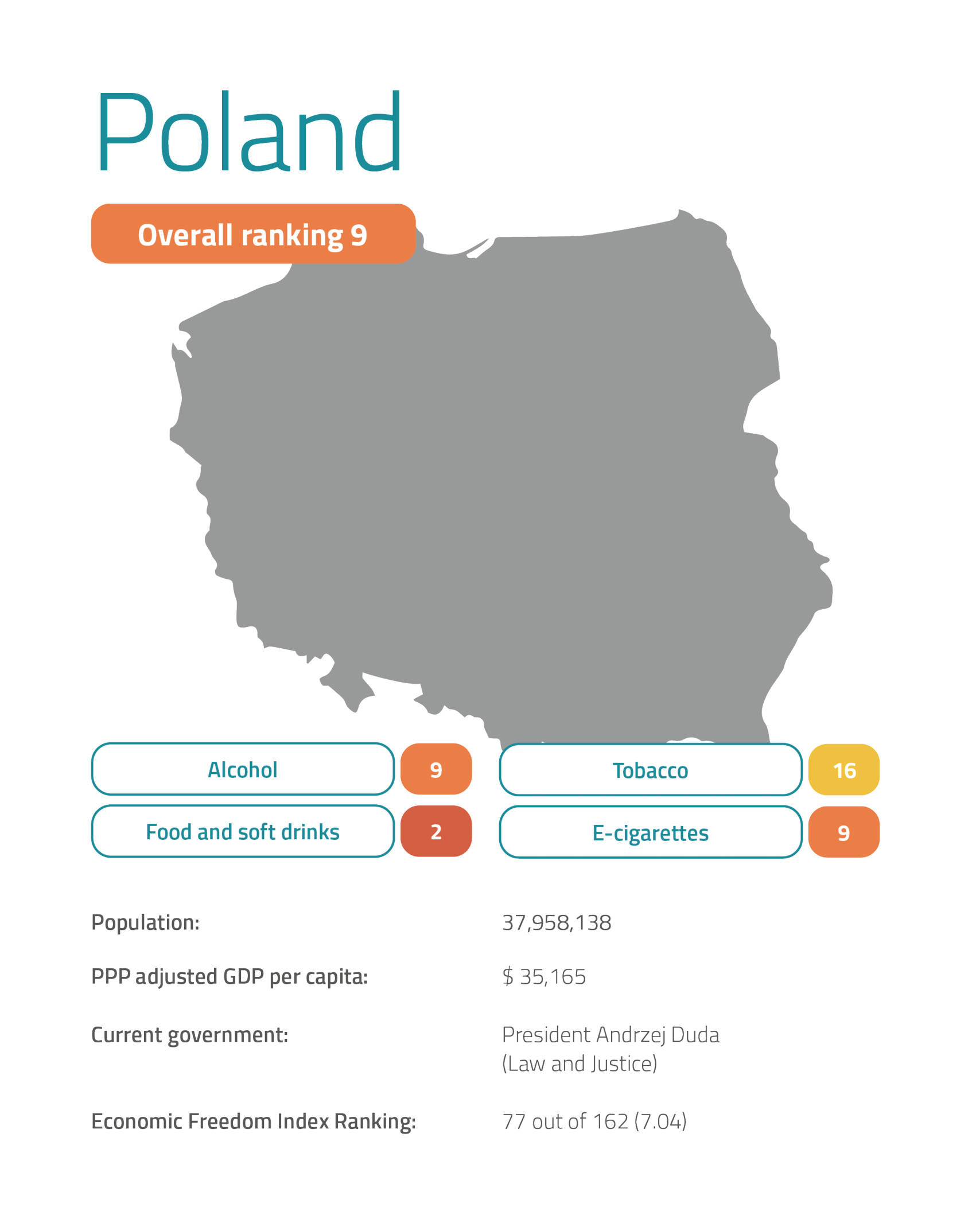

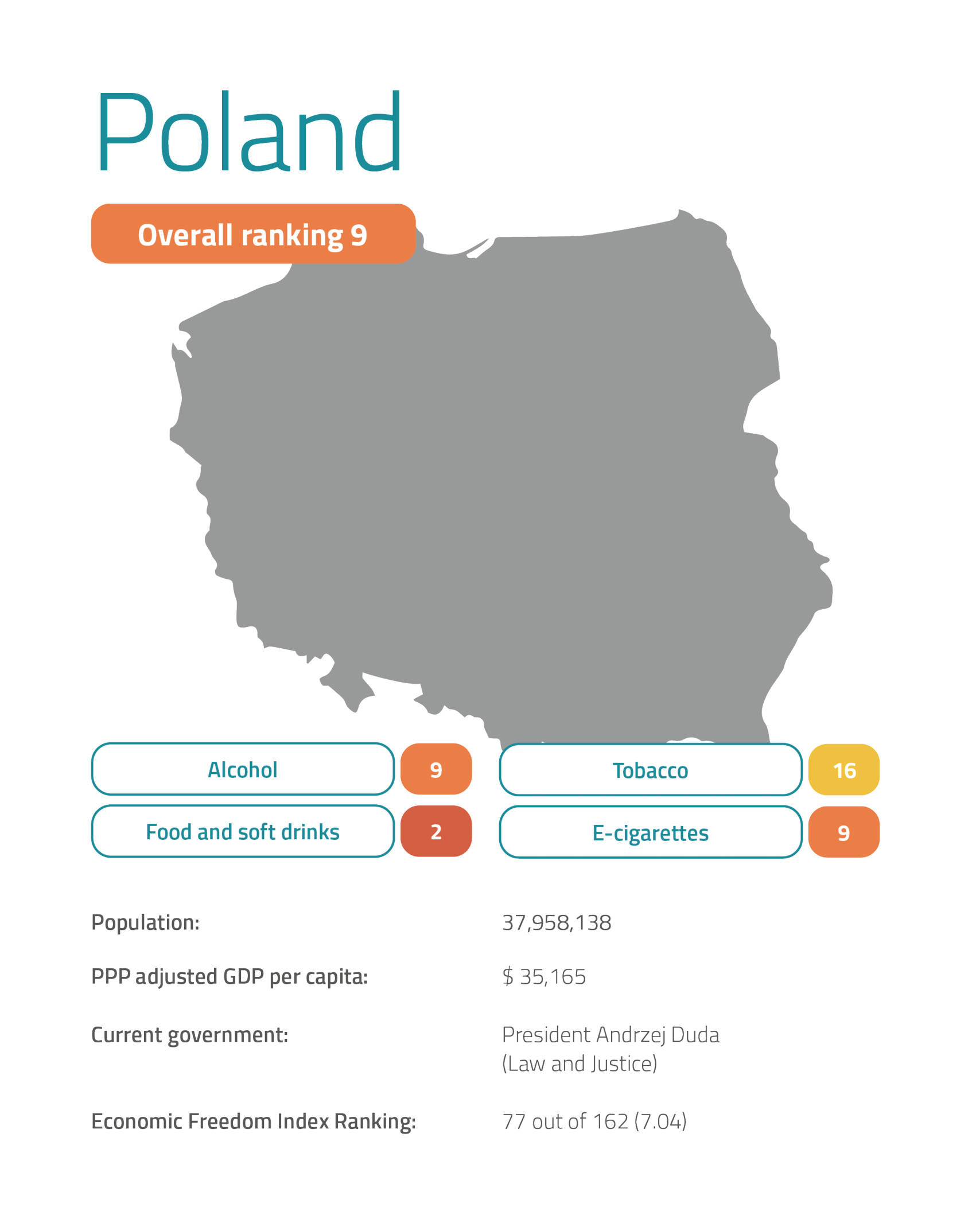

Poland jumps up to ninth place in this edition of the Nanny State Index after introducing a sugar tax and e-cigarette tax. Taxes on alcohol are well above the EU average once adjusted for income. In 2021, a new tax on spirits sold in small bottles (under 300ml) was introduced to discourage their consumption. Levied at 25 zloty (€5.55) per litre of pure alcohol, it led to at least one company producing a range of 350ml bottles.

Wine and spirits advertising is banned entirely and beer can only be advertised on television after 8 pm, with advertisements subject to a ten per cent tax. A bill to extend the beer advertising watershed to 11 pm was drawn up by the Ministry of Health in 2017 but not passed. Drinking is illegal on streets and in parks unless municipal authorities specifically allow it in designated places. In February 2018, the government passed a law allowing local authorities to limit the number of liquor stores and restrict sales after 10 pm.

During the COVID-19 pandemic, opposition politicians tabled a bill to repeal the communist-era ban on alcohol deliveries and legalise online sales, but the government rejected it. There are different interpretations of the ban and loopholes in the law so some sellers offer alcohol online. Nevertheless, it was not possible to have alcohol delivered with takeaway meals which additionally harmed restaurants during the lockdowns.

Poland has a near-total ban on tobacco advertising and a ban on cigarette vending machines. It is even illegal to display products that imitate the packaging of cigarettes, but there is no retail display ban. It has a severe, though not total, ban on smoking in bars, restaurants and workplaces. Poland was particularly badly hit by the EU’s ban on menthol cigarettes, which came into force in May 2020, since around 30 per cent of Polish smokers prefer menthol.

In September 2016, Poland banned e-cigarette advertising, cross-border sales and vaping indoors in places where smoking is banned, including almost all bars and bus stops. In October 2020, the government implemented a tax of 0.55 zloty (€0.12) per ml of e-cigarette fluid and introduced a tax on heated tobacco of 155.79 zloty (€34) per kilogram plus a 32.05 per cent ad valorem tax. The Ministry of Justice and some other politicians want to further increase taxes on heated tobacco to reduce the differences in tax burden between these lower risk products and traditional cigarettes.

A sugary drink tax passed through the parliament in 2020 and was implemented at the beginning of 2021. When critics accused the government of breaking its promise to not raise taxes, the deputy finance minister said that the sugary drinks tax was “a surcharge, not a tax.” The “surcharge” amounts to 0.5 Polish zloty (€0.12) per litre for drinks with 5g sugar per 100ml or less, plus 0.05 Polish zloty (€0.012) for each additional gram of sugar above 5g/100ml. The tax applies to artificially sweetened drinks as well as sugary drinks. Energy drinks face an additional tax of 0.10 zloty (€0.022) per litre.

Poland’s Ministry of Finance and Ministry of Health have expressed interest in taxing so-called ‘junk food’. Fortunately, nothing has come of this yet.

With thanks to Marek Tatala, Civil Development Forum

About

The Nanny State Index (NSI) is a league table of the worst places in Europe to eat, drink, smoke and vape. The initiative was launched in March 2016 and was a media hit right across Europe. It is masterminded and led by IEA’s Christopher Snowdon with partners from all over Europe.

Enquiries: info@epicenternetwork.eu

Download Publication

Previous version: 2019

Categories

About the Editor

Christopher Snowdon is the head of Lifestyle Economics at the Institute of Economic Affairs. His research focuses on lifestyle freedoms, prohibition and policy-based evidence. He is a regular contributor to the Spectator, Telegraph and Spiked and often appears on TV and radio discussing social and economic issues.

Snowdon’s work encompasses a diverse range of topics including ‘sin taxes’, state funding of charities, happiness economics, ‘public health’ regulation, gambling and the black market. Recent publications include ‘Drinking, Fast and Slow’, ‘The Proof of the Pudding: Denmark’s Fat Tax Fiasco’, ‘A Safer Bet’, and ‘You Had One Job’. He is also the author of ‘Killjoys’ (2017), ‘Selfishness, Greed and Capitalism’ (2015), ‘The Art of Suppression’ (2011), ‘The Spirit Level Delusion’ (2010), ‘Velvet Glove, Iron Fist’ (2009).

Poland 2021

Poland jumps up to ninth place in this edition of the Nanny State Index after introducing a sugar tax and e-cigarette tax. Taxes on alcohol are well above the EU average once adjusted for income. In 2021, a new tax on spirits sold in small bottles (under 300ml) was introduced to discourage their consumption. Levied at 25 zloty (€5.55) per litre of pure alcohol, it led to at least one company producing a range of 350ml bottles.

Wine and spirits advertising is banned entirely and beer can only be advertised on television after 8 pm, with advertisements subject to a ten per cent tax. A bill to extend the beer advertising watershed to 11 pm was drawn up by the Ministry of Health in 2017 but not passed. Drinking is illegal on streets and in parks unless municipal authorities specifically allow it in designated places. In February 2018, the government passed a law allowing local authorities to limit the number of liquor stores and restrict sales after 10 pm.

During the COVID-19 pandemic, opposition politicians tabled a bill to repeal the communist-era ban on alcohol deliveries and legalise online sales, but the government rejected it. There are different interpretations of the ban and loopholes in the law so some sellers offer alcohol online. Nevertheless, it was not possible to have alcohol delivered with takeaway meals which additionally harmed restaurants during the lockdowns.

Poland has a near-total ban on tobacco advertising and a ban on cigarette vending machines. It is even illegal to display products that imitate the packaging of cigarettes, but there is no retail display ban. It has a severe, though not total, ban on smoking in bars, restaurants and workplaces. Poland was particularly badly hit by the EU’s ban on menthol cigarettes, which came into force in May 2020, since around 30 per cent of Polish smokers prefer menthol.

In September 2016, Poland banned e-cigarette advertising, cross-border sales and vaping indoors in places where smoking is banned, including almost all bars and bus stops. In October 2020, the government implemented a tax of 0.55 zloty (€0.12) per ml of e-cigarette fluid and introduced a tax on heated tobacco of 155.79 zloty (€34) per kilogram plus a 32.05 per cent ad valorem tax. The Ministry of Justice and some other politicians want to further increase taxes on heated tobacco to reduce the differences in tax burden between these lower risk products and traditional cigarettes.

A sugary drink tax passed through the parliament in 2020 and was implemented at the beginning of 2021. When critics accused the government of breaking its promise to not raise taxes, the deputy finance minister said that the sugary drinks tax was “a surcharge, not a tax.” The “surcharge” amounts to 0.5 Polish zloty (€0.12) per litre for drinks with 5g sugar per 100ml or less, plus 0.05 Polish zloty (€0.012) for each additional gram of sugar above 5g/100ml. The tax applies to artificially sweetened drinks as well as sugary drinks. Energy drinks face an additional tax of 0.10 zloty (€0.022) per litre.

Poland’s Ministry of Finance and Ministry of Health have expressed interest in taxing so-called ‘junk food’. Fortunately, nothing has come of this yet.

With thanks to Marek Tatala, Civil Development Forum

Austria

Austria Belgium

Belgium Bulgaria

Bulgaria Croatia

Croatia Cyprus

Cyprus Czech Republic

Czech Republic Denmark

Denmark Estonia

Estonia Finland

Finland France

France Germany

Germany Greece

Greece Hungary

Hungary Ireland

Ireland Italy

Italy Latvia

Latvia Lithuania

Lithuania Luxembourg

Luxembourg Malta

Malta Netherlands

Netherlands Norway

Norway Poland

Poland Portugal

Portugal Romania

Romania Slovakia

Slovakia Slovenia

Slovenia Spain

Spain Sweden

Sweden Turkey

Turkey United Kingdom

United Kingdom