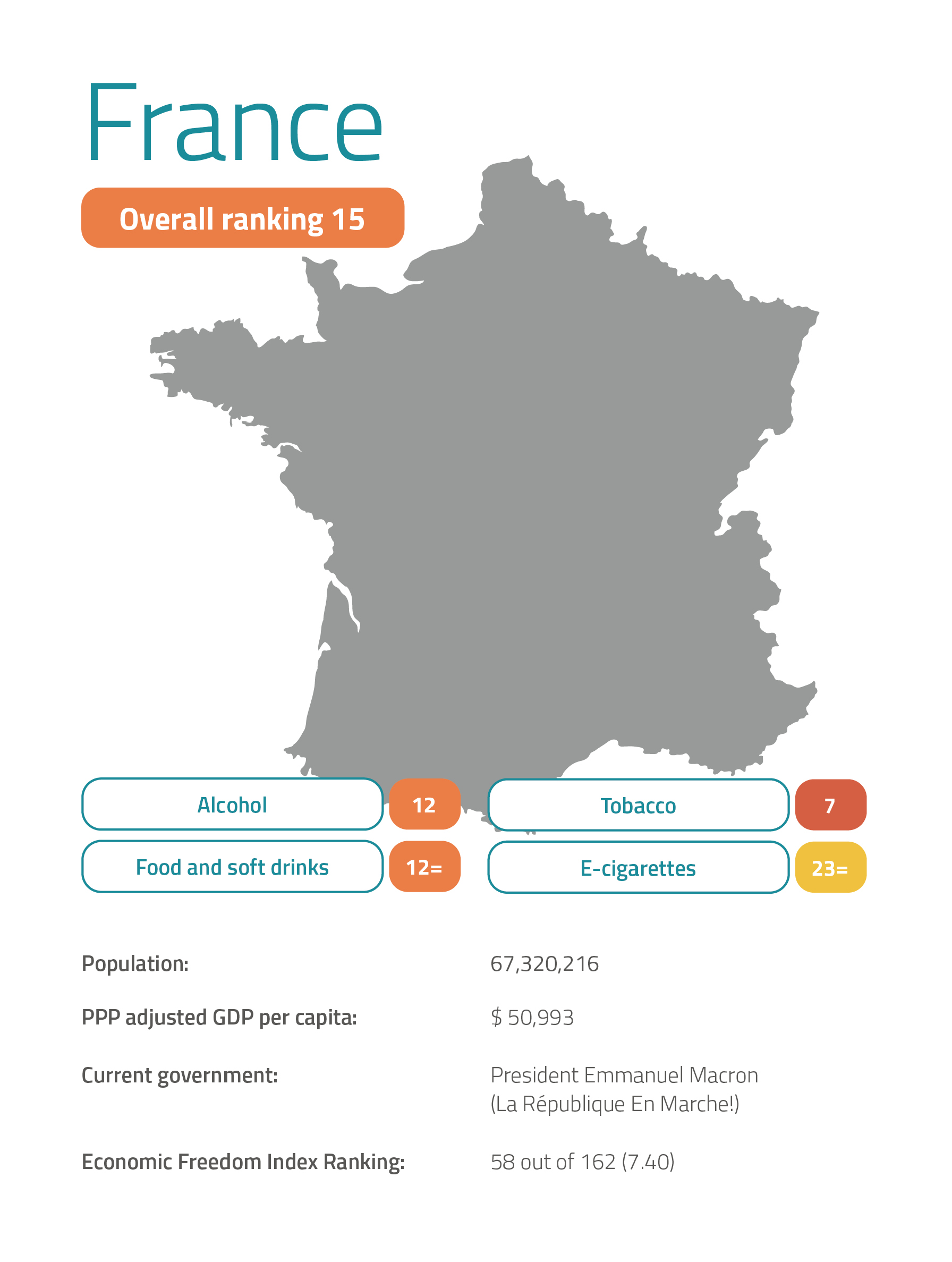

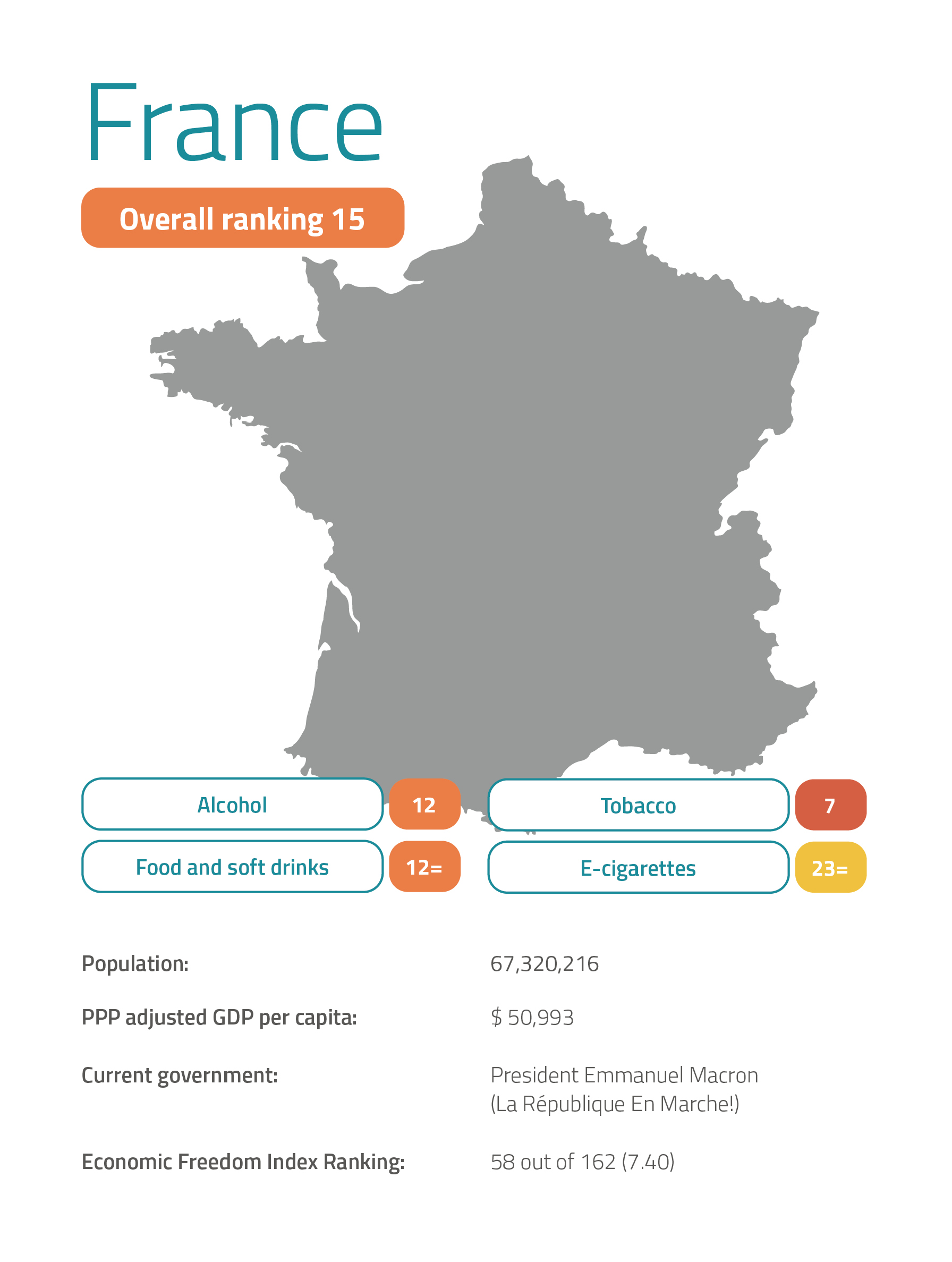

France sits mid-table in the Nanny State Index despite the efforts of successive governments to suck the joie de vivre out of the country. It has a sugar tax and some harsh anti-smoking legislation but it remains relatively enlightened when it comes to vaping and food regulation.

The French government considered a ban on vaping in public places in 2013 but decided against it. Vaping is currently legal in bars and restaurants but since October 2017 it has been prohibited in educational institutions, public transport and open plan offices. People who flout the ban can be fined between €35 and €150. In places where vaping is permitted, legislation obliges the owner to put up a sign telling customers what their vaping policy is.

There is an extensive ban on smoking in bars, restaurants and workplaces, but some smoking rooms are permitted. Smoking is banned in cars carrying passengers under the age of 18 and there has recently been a trend towards banning smoking outdoors. Paris has now banned smoking in 52 parks and gardens. Marseilles and La Rochelle have both banned smoking on several beaches. There has even been talk of banning the depiction of smoking in films, a proposal that was welcomed by the European Commission.

A tobacco display ban is in place and France is one of six EU countries to have introduced plain packaging. Large increases in tobacco taxation in the last decade have left the French with the third highest cigarette duty in the EU (after Ireland and the UK), but tax on heated tobacco is less extortionate.

In July 2018, France changed its system of taxing soft drinks. It had previously levied a tax of €0.0753 per litre on all sweetened drinks and energy drinks, including low calorie varieties. It now taxes sweetened drinks which contain no sugar at a lower rate of €0.03 per litre and this rate rises in proportion to sugar content. For example, a litre of a drink which has five grams of sugar per 100ml is taxed at €0.055 per litre and a drink with 10g/100ml is taxed at €0.135.

Free refills of soft drinks in restaurants were banned in January 2017. A 2004 ban on sweets and sugary drinks being sold from vending machines had no effect on children’s calorie intake. Undeterred by failure, the government banned all food and drink vending machines from schools in 2017.

There is a full ban on tobacco advertising and a near-total ban on e-cigarette advertising. The latter is only legal in vape shops. All television adverts for food that is processed or contains added sugar, fat, sweeteners and/or salt must be accompanied by a message from the National Institute of Health Education (e.g. ‘For your health, avoid snacking between meals’). France has had some of the world’s most restrictive alcohol advertising laws since 1991, with a total ban on television and heavy restrictions on what companies can say about their product in other media.

The sale of alcohol is banned in sports stadiums. When a bill was put forward in 2019 to relax this law, the health minister Agnès Buzyn responded by saying that it should instead be extended to include VIP areas. The law requiring all drivers to keep a breathalyser in their car has, however, now been repealed.

There is a special tax on beverages that contain more than 18 per cent alcohol. Known as the ‘cotisation de sécurité sociale’, it adds €5.79 to a litre of strong drink. Fortunately, wine remains affordable with a tax of just €0.03 per bottle.

About

The Nanny State Index (NSI) is a league table of the worst places in Europe to eat, drink, smoke and vape. The initiative was launched in March 2016 and was a media hit right across Europe. It is masterminded and led by IEA’s Christopher Snowdon with partners from all over Europe.

Enquiries: info@epicenternetwork.eu

Download Publication

Previous version: 2019

Categories

About the Editor

Christopher Snowdon is the head of Lifestyle Economics at the Institute of Economic Affairs. His research focuses on lifestyle freedoms, prohibition and policy-based evidence. He is a regular contributor to the Spectator, Telegraph and Spiked and often appears on TV and radio discussing social and economic issues.

Snowdon’s work encompasses a diverse range of topics including ‘sin taxes’, state funding of charities, happiness economics, ‘public health’ regulation, gambling and the black market. Recent publications include ‘Drinking, Fast and Slow’, ‘The Proof of the Pudding: Denmark’s Fat Tax Fiasco’, ‘A Safer Bet’, and ‘You Had One Job’. He is also the author of ‘Killjoys’ (2017), ‘Selfishness, Greed and Capitalism’ (2015), ‘The Art of Suppression’ (2011), ‘The Spirit Level Delusion’ (2010), ‘Velvet Glove, Iron Fist’ (2009).

France 2021

France sits mid-table in the Nanny State Index despite the efforts of successive governments to suck the joie de vivre out of the country. It has a sugar tax and some harsh anti-smoking legislation but it remains relatively enlightened when it comes to vaping and food regulation.

The French government considered a ban on vaping in public places in 2013 but decided against it. Vaping is currently legal in bars and restaurants but since October 2017 it has been prohibited in educational institutions, public transport and open plan offices. People who flout the ban can be fined between €35 and €150. In places where vaping is permitted, legislation obliges the owner to put up a sign telling customers what their vaping policy is.

There is an extensive ban on smoking in bars, restaurants and workplaces, but some smoking rooms are permitted. Smoking is banned in cars carrying passengers under the age of 18 and there has recently been a trend towards banning smoking outdoors. Paris has now banned smoking in 52 parks and gardens. Marseilles and La Rochelle have both banned smoking on several beaches. There has even been talk of banning the depiction of smoking in films, a proposal that was welcomed by the European Commission.

A tobacco display ban is in place and France is one of six EU countries to have introduced plain packaging. Large increases in tobacco taxation in the last decade have left the French with the third highest cigarette duty in the EU (after Ireland and the UK), but tax on heated tobacco is less extortionate.

In July 2018, France changed its system of taxing soft drinks. It had previously levied a tax of €0.0753 per litre on all sweetened drinks and energy drinks, including low calorie varieties. It now taxes sweetened drinks which contain no sugar at a lower rate of €0.03 per litre and this rate rises in proportion to sugar content. For example, a litre of a drink which has five grams of sugar per 100ml is taxed at €0.055 per litre and a drink with 10g/100ml is taxed at €0.135.

Free refills of soft drinks in restaurants were banned in January 2017. A 2004 ban on sweets and sugary drinks being sold from vending machines had no effect on children’s calorie intake. Undeterred by failure, the government banned all food and drink vending machines from schools in 2017.

There is a full ban on tobacco advertising and a near-total ban on e-cigarette advertising. The latter is only legal in vape shops. All television adverts for food that is processed or contains added sugar, fat, sweeteners and/or salt must be accompanied by a message from the National Institute of Health Education (e.g. ‘For your health, avoid snacking between meals’). France has had some of the world’s most restrictive alcohol advertising laws since 1991, with a total ban on television and heavy restrictions on what companies can say about their product in other media.

The sale of alcohol is banned in sports stadiums. When a bill was put forward in 2019 to relax this law, the health minister Agnès Buzyn responded by saying that it should instead be extended to include VIP areas. The law requiring all drivers to keep a breathalyser in their car has, however, now been repealed.

There is a special tax on beverages that contain more than 18 per cent alcohol. Known as the ‘cotisation de sécurité sociale’, it adds €5.79 to a litre of strong drink. Fortunately, wine remains affordable with a tax of just €0.03 per bottle.

Austria

Austria Belgium

Belgium Bulgaria

Bulgaria Croatia

Croatia Cyprus

Cyprus Czech Republic

Czech Republic Denmark

Denmark Estonia

Estonia Finland

Finland France

France Germany

Germany Greece

Greece Hungary

Hungary Ireland

Ireland Italy

Italy Latvia

Latvia Lithuania

Lithuania Luxembourg

Luxembourg Malta

Malta Netherlands

Netherlands Norway

Norway Poland

Poland Portugal

Portugal Romania

Romania Slovakia

Slovakia Slovenia

Slovenia Spain

Spain Sweden

Sweden Turkey

Turkey United Kingdom

United Kingdom