Czechia’s reputation as a haven of liberty took a knock in May 2017 when an extensive smoking ban came into effect. The ban allows for no designated smoking rooms and no exemptions, except for shisha. A survey conducted at the end of 2017 found that 58 per cent of Czechs thought the ban was too extreme, but attempts to partially relax it have failed. Fines of 5,000 CZK (€185) can be imposed on those who break the law and the owners of venues can be fined up to 50,000 CZK (€1,850).

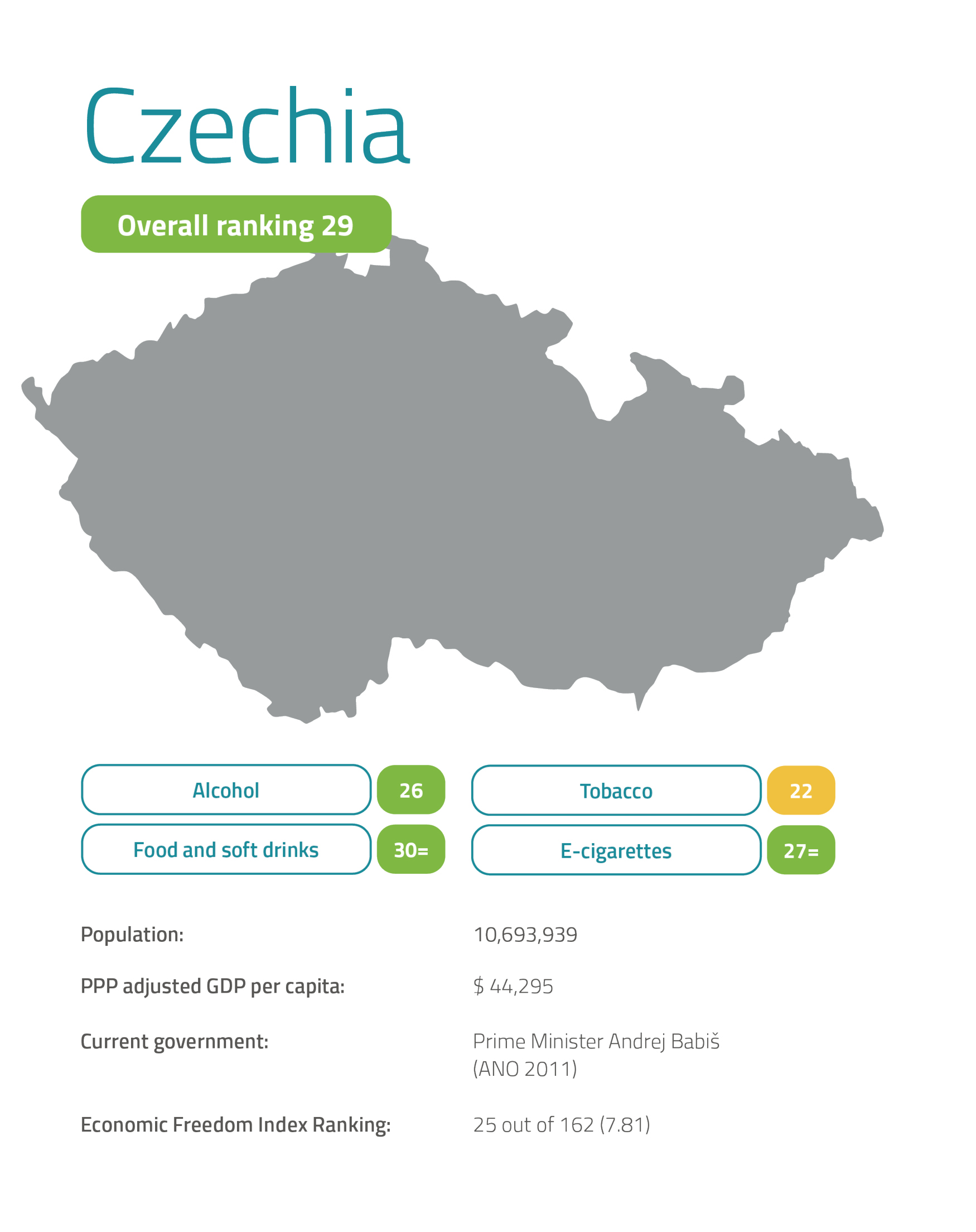

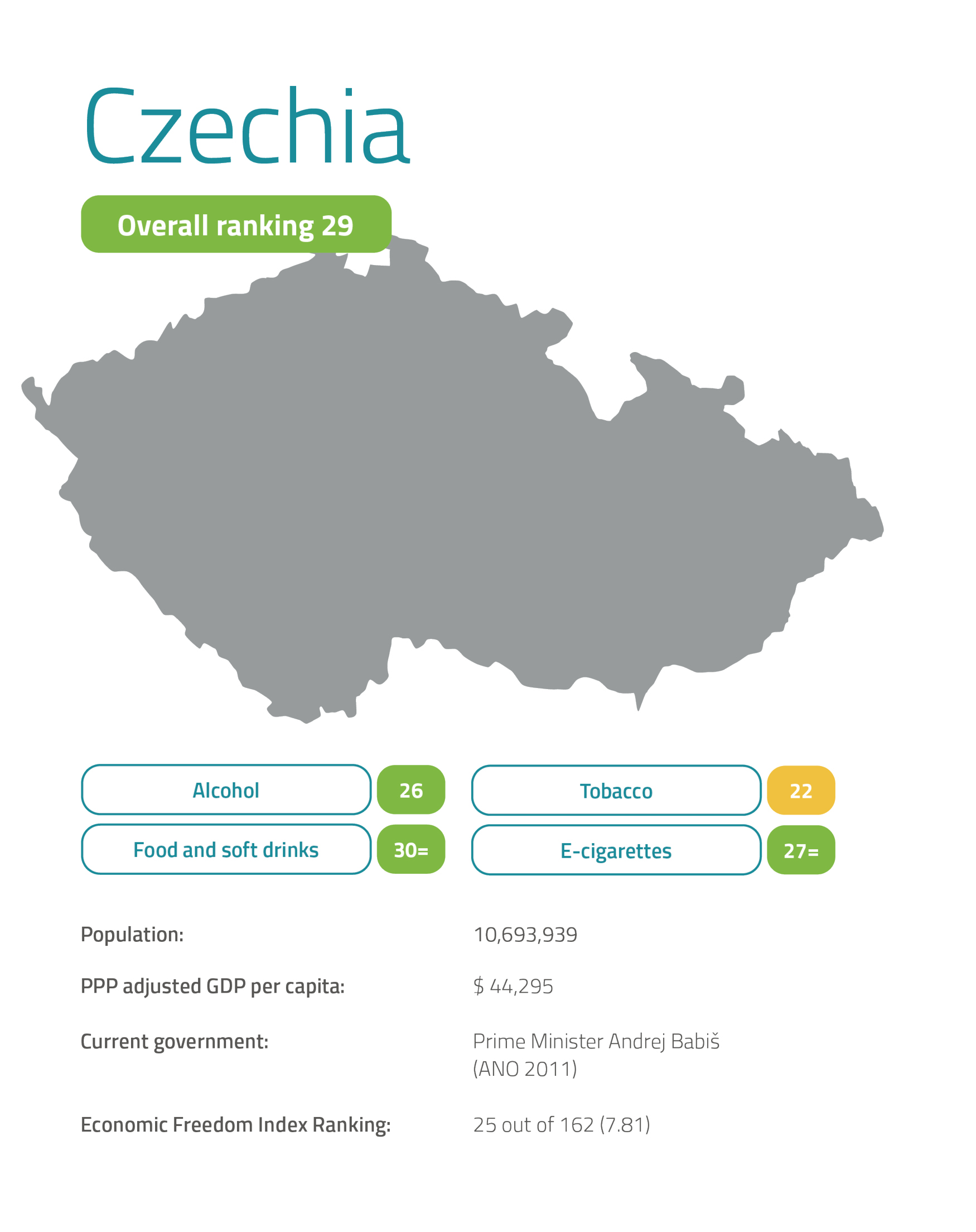

The smoking ban is the main reason why Czechia lost its crown as the most liberal EU country in the 2019 Nanny State Index. It remains just above Germany in the table this year and continues to score well on food, alcohol and e-cigarette regulation.

E-cigarettes can be advertised within the confines of EU law and vaping is only prohibited in a limited number of public places such as airports and public transport. There are no sin taxes on vape juice, food or soft drinks, and alcohol advertising is largely unrestricted except in some outdoor areas (eg. outside schools).

Czechia is a beer-drinkers’ paradise, with low rates of tax and no mandatory closing time for bars. In 2020, the government reduced VAT on beer sold in restaurants from 21 per cent to 10 per cent. Duty on spirits is average by European standards and there is no wine duty at all.

Tobacco taxes have been rising for years and are now about average for an EU member state once adjusted for income. Cigarettes can be displayed in shops and bought from vending machines, but the sale of alcohol from vending machines was banned in 2018.

With thanks to Peter Kotka

About

The Nanny State Index (NSI) is a league table of the worst places in Europe to eat, drink, smoke and vape. The initiative was launched in March 2016 and was a media hit right across Europe. It is masterminded and led by IEA’s Christopher Snowdon with partners from all over Europe.

Enquiries: info@epicenternetwork.eu

Download Publication

Previous version: 2019

Categories

About the Editor

Christopher Snowdon is the head of Lifestyle Economics at the Institute of Economic Affairs. His research focuses on lifestyle freedoms, prohibition and policy-based evidence. He is a regular contributor to the Spectator, Telegraph and Spiked and often appears on TV and radio discussing social and economic issues.

Snowdon’s work encompasses a diverse range of topics including ‘sin taxes’, state funding of charities, happiness economics, ‘public health’ regulation, gambling and the black market. Recent publications include ‘Drinking, Fast and Slow’, ‘The Proof of the Pudding: Denmark’s Fat Tax Fiasco’, ‘A Safer Bet’, and ‘You Had One Job’. He is also the author of ‘Killjoys’ (2017), ‘Selfishness, Greed and Capitalism’ (2015), ‘The Art of Suppression’ (2011), ‘The Spirit Level Delusion’ (2010), ‘Velvet Glove, Iron Fist’ (2009).

Czechia 2021

Czechia’s reputation as a haven of liberty took a knock in May 2017 when an extensive smoking ban came into effect. The ban allows for no designated smoking rooms and no exemptions, except for shisha. A survey conducted at the end of 2017 found that 58 per cent of Czechs thought the ban was too extreme, but attempts to partially relax it have failed. Fines of 5,000 CZK (€185) can be imposed on those who break the law and the owners of venues can be fined up to 50,000 CZK (€1,850).

The smoking ban is the main reason why Czechia lost its crown as the most liberal EU country in the 2019 Nanny State Index. It remains just above Germany in the table this year and continues to score well on food, alcohol and e-cigarette regulation.

E-cigarettes can be advertised within the confines of EU law and vaping is only prohibited in a limited number of public places such as airports and public transport. There are no sin taxes on vape juice, food or soft drinks, and alcohol advertising is largely unrestricted except in some outdoor areas (eg. outside schools).

Czechia is a beer-drinkers’ paradise, with low rates of tax and no mandatory closing time for bars. In 2020, the government reduced VAT on beer sold in restaurants from 21 per cent to 10 per cent. Duty on spirits is average by European standards and there is no wine duty at all.

Tobacco taxes have been rising for years and are now about average for an EU member state once adjusted for income. Cigarettes can be displayed in shops and bought from vending machines, but the sale of alcohol from vending machines was banned in 2018.

With thanks to Peter Kotka

Austria

Austria Belgium

Belgium Bulgaria

Bulgaria Croatia

Croatia Cyprus

Cyprus Czech Republic

Czech Republic Denmark

Denmark Estonia

Estonia Finland

Finland France

France Germany

Germany Greece

Greece Hungary

Hungary Ireland

Ireland Italy

Italy Latvia

Latvia Lithuania

Lithuania Luxembourg

Luxembourg Malta

Malta Netherlands

Netherlands Norway

Norway Poland

Poland Portugal

Portugal Romania

Romania Slovakia

Slovakia Slovenia

Slovenia Spain

Spain Sweden

Sweden Turkey

Turkey United Kingdom

United Kingdom